Cash Flow From Operating Activities Direct or Indirect Formula

For example, if you calculate cash flow for 2019, make sure you use 2018 and 2019 balance sheets. Free cash flow is the money left over after a company pays for its operating expenses and any capital expenditures. Free cash flow is considered an important measure of a company’s profitability and financial health. Another strategy to increase CFFA is to sell underutilized assets that are not essential to core business operations, providing an immediate cash influx. Continuously evaluating and reducing unnecessary expenses, managing debt efficiently, and revising pricing strategies can also enhance cash flow from assets.

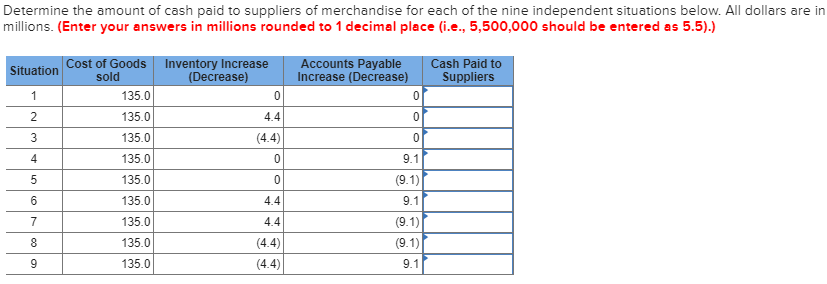

Cash Flow Statement Calculation Example

Cash flow refers to the amount of money moving into and out of a company, while revenue represents the income the company earns on how to calculate cash flow from assets the sales of its products and services. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Cash Flow Statement (CFS)

- Cash flow from financing activities provides investors with insight into a company’s financial strength and how well its capital structure is managed.

- Regularly updating your cash flow statement will not only help you make informed decisions but also forecast future financial performance.

- It’s the money available to investors, company management, shareholder dividends, and investments back into the business.

- In contrast, the income statement is important as it provides information about the profitability of a company.

- Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities over a pre-defined period.

Cash flow from operating activities will increase when prepaid expenses decrease. In contrast, cash flow from operating activities will decrease when there is an increase in prepaid expenses. It is these operating cash flows which must, in the end, pay off all cash outflows relating to other activities (e.g., paying loan interest, dividends, and so on). Cash flow from operating activities (CFO) shows the amount of cash generated from the regular operations of an enterprise to maintain its operational capabilities. This can include both operating necessities and investments that don’t impact day-to-day operations. This measurement does not account for any financing sources, such as Bookstime the use of debt or stock sales to offset any negative cash flow from assets.

- Assuming the firm is about to see more than one growth stage, the calculation is a combination of each of these stages.

- Changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are generally reflected in cash from operations.

- Either way, your current assets will still be determined by what you can turn into cash during that cycle.

- To place numbers into this idea, we could look at these potential cash flows from the operations and find what they are worth based on their present value.

- This underlines the significance of businesses having a high cash flow from assets, as it can lead to lower rates and fees from financial institutions for potential lending options.

- While these adjustments do not directly affect cash flows, they indicate the financial implications of investment decisions made by the company.

- Cash flow statements have been required by the Financial Accounting Standards Board (FASB) since 1987.

Cash flow forecast = Beginning cash + Projected inflows – Projected outflows = Ending cash

This includes any dividends, payments for stock repurchases, and repayment of debt principal (loans) that are made by the company. Efficient management of accounting-related processes also plays a significant role in boosting CFFA. Accelerating the collection of accounts receivables through early payment discounts and proactive credit policies can expedite cash inflows. Additionally, monitoring inventory levels and implementing just-in-time inventory systems can reduce holding costs and optimize cash utilization.

Cash Flow From Operating Activities

It’s the money available to investors, company management, shareholder dividends, and investments back into the business. While depreciation is an expense that reduces a what are retained earnings company’s net income, it doesn’t represent an actual cash outflow. As a result, depreciation is added back into the cash flow statement to determine the real cash generated by operating activities. An increase in accounts payable reflects a source of cash, as it indicates that expenses were incurred but not yet paid out in cash. Each adjustment made should be based on whether the change represents an increase or decrease in cash, leading to a comprehensive view of cash flows from operating activities.

At first, it can be challenging, but you will manage your business finances better once you get the hang of things. Negative cash flow should not automatically raise a red flag without further analysis. Poor cash flow is sometimes the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future. While both FCF and OCF give you a good idea of cash flow in a given period, that isn’t always what you need when it comes to planning for the future. That’s why forecasting your cash flow for the upcoming month or quarter is a good exercise to help you better understand how much cash you’ll have on hand in the future.Because let’s be real. Cash flow problems are never fun, so it’s important to ensure positive cash flow before you start spending.

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Cash flow statements have been required by the Financial Accounting Standards Board (FASB) since 1987.