Accounts Payable Outsourcing Services Guide

This may involve refining processes, implementing new technologies, or adjusting the scope of outsourced services to align with evolving requirements. Ensuring compliance with relevant regulations and industry standards is a critical aspect of successful accounts payable outsourcing. By closely monitoring performance, businesses can identify areas for improvement and work collaboratively with the outsourcing provider to address any issues or inefficiencies that may arise. Establishing clear communication channels and scheduling regular meetings or check-ins can facilitate open dialogue and enable prompt resolution of any challenges. The accounts payable outsourcing process typically begins with an initial assessment and planning phase. During this stage, the outsourcing provider carefully evaluates the client’s current AP processes, pain points, and requirements.

Difficult to report errors

Andy is a technology & marketing leader who has delivered award-winning and world-first experiences. Explore opportunities with innovative companies and build a fulfilling career as a skilled professional at the forefront of the industry. Even a small error, such as an inaccurate payment to a vendor, can cause serious problems during an audit. Managing your relationships with vendors and suppliers is challenging enough. Below, we’ll explore these benefits and how they can directly impact your organization’s bottom line.

Access to Expertise

Outsourced accounts payable providers have all the resources they need to optimize your process, including automation and reporting tools. Instead of going through the process of acquiring these tools themselves, many companies choose to outsource to get access to their benefits at a fraction of the cost. Outsourcing is not merely the shifting manual tasks like data entry to an outsourced provider. According to most case studies, companies typically use process outsourcing to add value to their businesses and to improve AP dramatically. Asking for references and case studies can also provide valuable insights into the provider’s track record and effectiveness in managing accounts payable processes for other organizations. Selecting the right accounts payable service provider is critical to ensure a successful partnership.

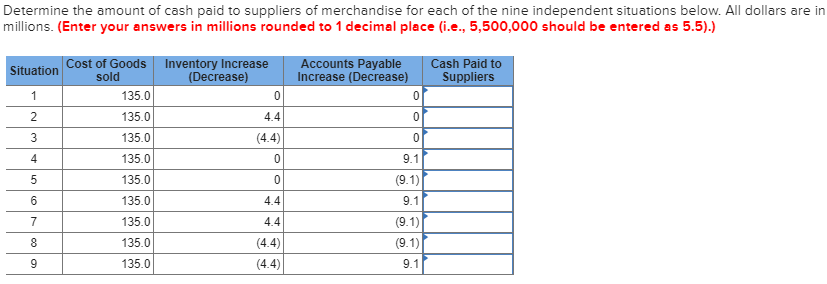

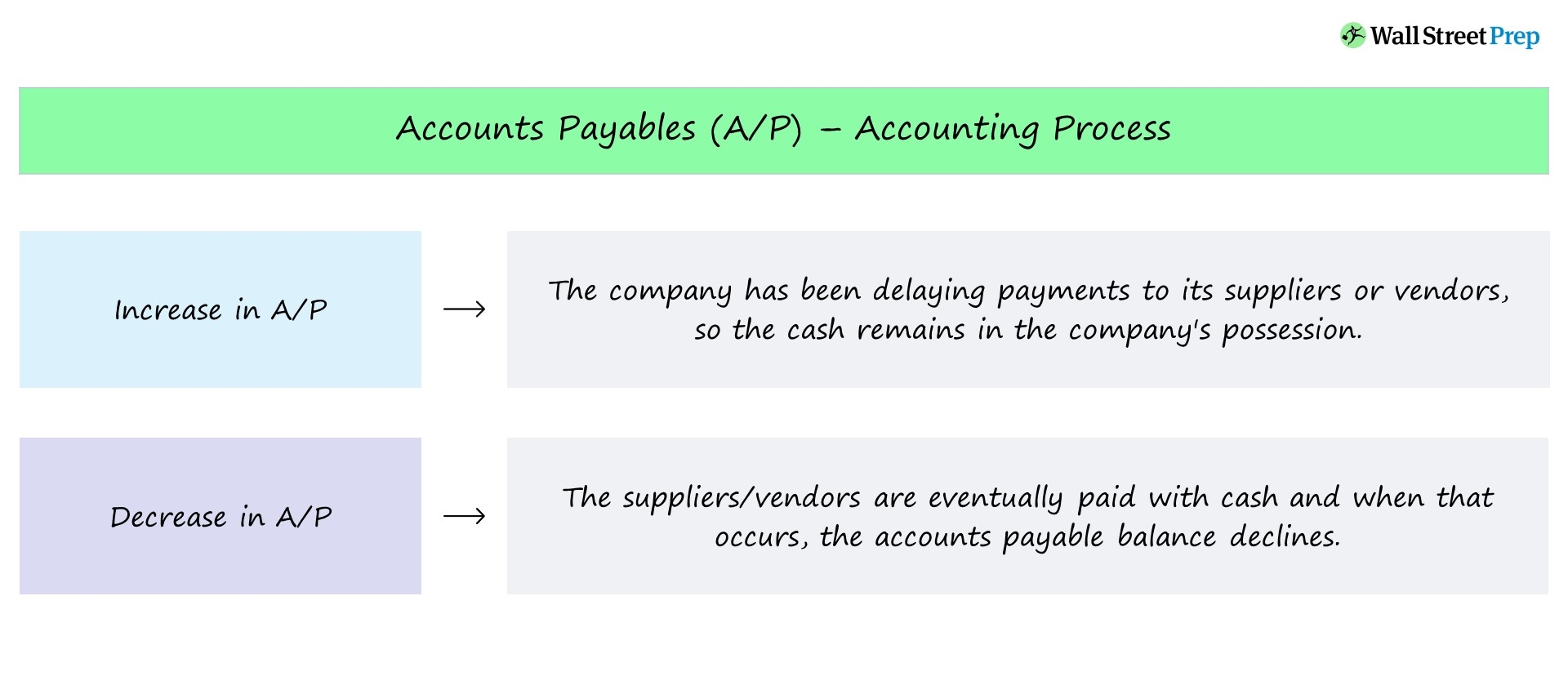

How AP Outsourcing Works

Evaluate your business’s growth and scalability needs, as outsourcing offers the flexibility to adapt to rapid growth without significant internal changes. Additionally, if managing AP tasks distract your team from core business goals, outsourcing can free up resources to focus on strategic initiatives that drive your objectives forward. Before selecting a provider, assess whether they can offer customizable services that align with your specific AP workflow.

AP providers come fully equipped with the tools, skills, and technology not only to manage your existing accounts payable functions but also to integrate new capabilities to give you a more streamlined environment. When assessing the cost and value of outsourcing AP services, year to date ytd it’s important to consider not only the upfront costs but also the long-term benefits. Additionally, consider the provider’s ability to integrate with your existing systems and processes, as seamless integration can help ensure a smooth transition and ongoing success of your accounts payable outsourcing efforts. By thoroughly assessing a provider’s capabilities, you can select the best-fit partner for your organization and ensure that your accounts payable processes are effectively managed.

- While these don’t give you the full picture, checking reviews and testimonials is a great place to start.

- They also prioritize customer satisfaction, going above and beyond to ensure that their clients’ needs are met.

- Outsourcing your accounts payable processes represents a significant time and monetary investment.

- The growing popularity of accounts payable outsourcing and accounting outsourcing, in general, can be attributed to a sustained need to make cost savings and compensate for labor shortages.

- The accounts payable outsourcing process typically begins with an initial assessment and planning phase.

This information is then used to develop a customized solution that aligns with the client’s specific needs and business objectives. While accounts payable outsourcing is a viable option for some organizations, many can get the benefits of outsourcing while maintaining higher efficiency and security using a procurement platform. Some companies find that the cost of outsourcing is offset by the overhead savings created by delegating certain processes to an external provider.

Laugh all the way to the bank as you witness the incredible reduction in expenses and the hilarity of watching your budget stretch like a rubber band. Through the power of outsourcing, you can bid farewell to the endless back-and-forth communication, missed deadlines, and frustrating negotiations. Experience the sheer delight of streamlined vendor management, where every interaction is a seamless dance of efficiency and hilarity.