Cash Flow Statements: Reviewing Cash Flow From Operations

It is important to note that there may be receipts and payments other than those discussed above. Direct method of operating activities cash flows is one of the two main techniques that may be used to calculate the net cash flow from operating activities in a cash flow statement, the other being indirect method. As you can see, listing these payments gives the financial statement user a great deal of information where receipts are coming from and where payments are going to.

What Is the Direct Method?

All sales and purchases were made on credit during the last quarter of the financial year. Therefore, no cash was paid to creditors or collected from debtors during the year. OCF is a prized measurement tool as it helps investors gauge what’s going on behind the scenes. For many investors and analysts, OCF is considered the cash version of net income, since it cleans the income statement of non-cash items and non-cash expenditures (depreciation, amortization, non-cash working capital items). Financing activities consist of activities that will alter the equity or borrowings of a company. Examples of financing activities include the sale of a company’s shares or the repurchase of its shares.

- A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method.

- DPO focuses on how long a company takes to pay its suppliers, while DSO measures how quickly a company collects payments from its customers.

- Receipts from customers, combined with cash sales, were $800,000, payments to suppliers of raw materials $400,000, other operating cash payments were $100,000 and cash paid on behalf and to employees was $126,000.

- At the start of the accounting period the company has retained earnings of $500 and at the reporting date retained earnings are $700.

- The following example shows the format and calculation of cash flows from operating activities using direct method.

Cash Flow From Operating Activities: Explanation

For this reason, the Financial Accounting Standards Board (FASB) recommends companies use the direct method. It should be noted that in both cases the cash flow from operating activities is 16,800. The other line items in the income statement above are depreciation, the interest expense, and income tax expense. It does so by GROUPING Cash Transactions into major classes of cash receipts and cash payments. With Stenn’s revenue-based financing options, you can seamlessly bridge cashflow gaps and accelerate your business growth.

Financial Statement Analysis

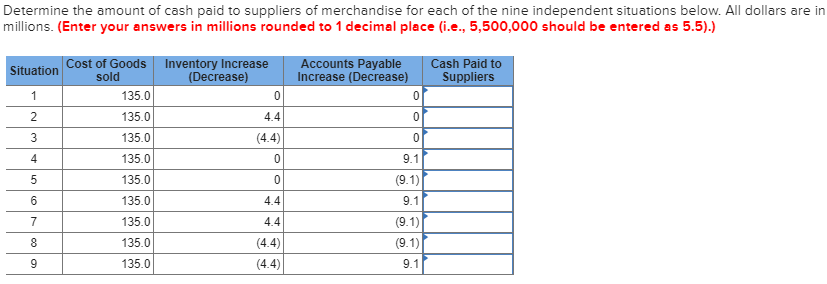

For example, an increase in the levels of inventory and receivables will not impact profit before tax but will have had an adverse impact on the cash flow of the business. Therefore, in the reconciliation process, the increases in inventory and trade receivables are deducted from profit before tax. Under the indirect method, the figures required for the calculation are obtained from information in the company’s profit and loss account and balance sheet. Cash paid for inventory is different from the cost of goods soldthat is recorded on the accrual basis financial statements. Toreconcile the amount of cost of goods sold reported on the incomestatement to the cash paid for inventory, it is necessary toperform two calculations. The first part of the calculationdetermines how much inventory was purchased, and the second part ofthe calculation determines how much of those purchases were paidfor during the current period.

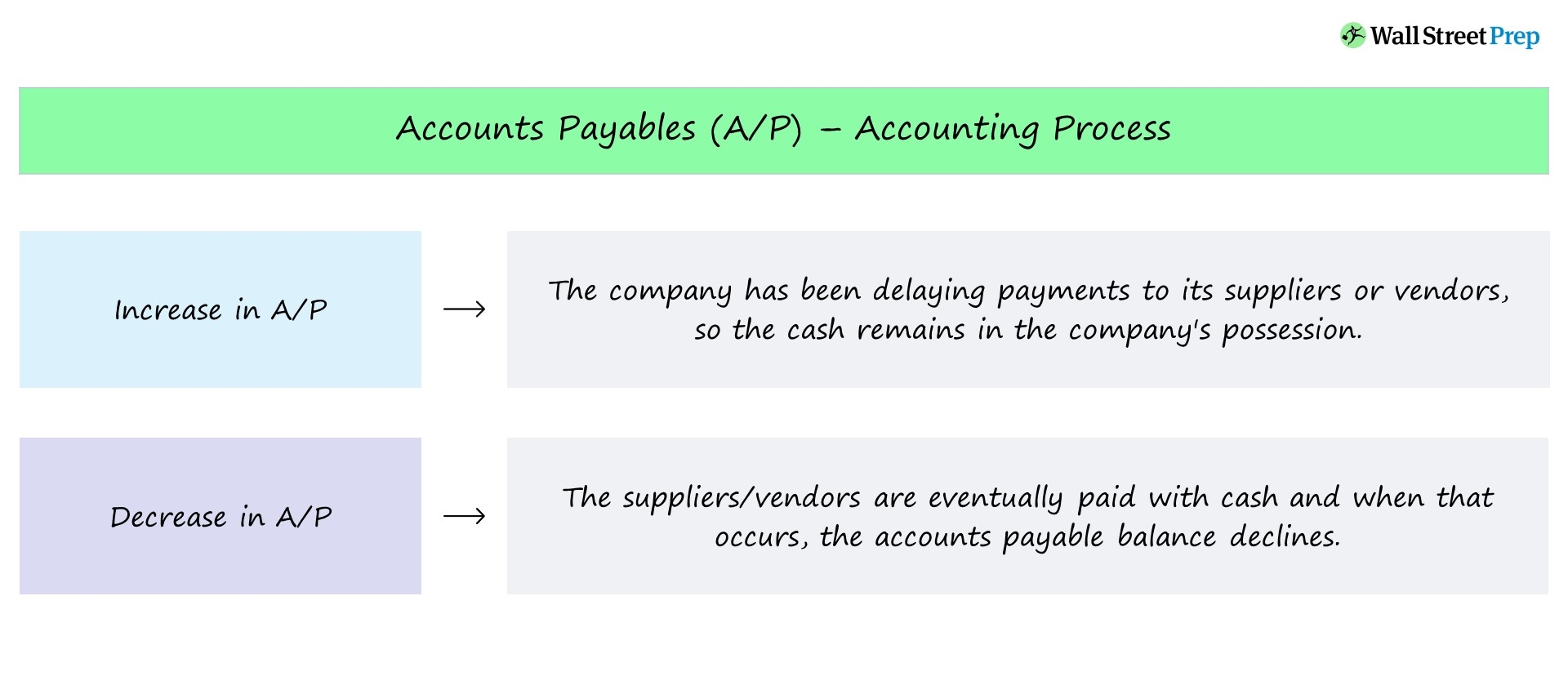

These movements are then used to present the indirect cash flow statement as follows. The cost of goods sold is adjusted to reflect any balance sheet inventory movements in order to calculate the amount of purchases from suppliers. A high DPO can improve cashflow but may strain supplier relationships. A low one can strengthen supplier relationships but may limit cashflow.

This number will most likely not be equal to the amount of product costs you purchased from suppliers during the period. It is possible to find the total amount of cash paid to suppliers by analyzing the company’s general ledger. The first step in preparing the cash flow statement involves the determination of the total cash flows from operating activities. The cash flow from the operations section of the cash flow statement can be prepared using either the direct method or the indirect method.

While DPO measures how long it takes to pay suppliers, Days Sales Outstanding (DSO) measures how quickly your company collects payments from customers. In other words, it reflects the effectiveness of your accounts receivable process. Add together the accounts you marked in Step 2 to determine the total cash you paid to suppliers for summary of federal tax law changes for 2010 the accounting period. Investing activities consist of payments made to purchase long-term assets, as well as cash received from the sale of long-term assets. Examples of investing activities are the purchase or sale of a fixed asset or property, plant, and equipment and the purchase or sale of a security issued by another entity.

Under the direct method, the information contained in the company’s accounting records is used to calculate the net CFO. Some transactions, such as the sale of an item of plant, may produce a loss or gain, which is included in the determination of net profit or loss. If you think cash is king, strong cash flow from operations is what you should watch for when analyzing a company. Note how whichever method is used that the same cash is generated from operating activities. At the start of the accounting period the company has retained earnings of $500 and at the reporting date retained earnings are $700. During the reporting period a profit for the year of $450 was reported.

To convert the accrual based cost of goods sold figure from the income statement to a cash paid basis the business needs to adjust for balance sheet movements on inventory, and accounts payable. Typically the direct method cash flow statement discloses gross cash receipts and payments for each of the following line items. Wages paid is calculated by adjusting total wages from the income statement for movements in wages payable (WP) from the balance sheet. The items need to be adjusted when calculating cash flow from operating activities because they are considered elsewhere in the cash flow statement (e.g., investing activities or financing activities).

To convert the accrual based sales revenue figure from the income statement to a cash received basis the business needs to adjust for the movement on accounts receivable during the year as shown below. The amount of interest receipts is calculated by adjusting the interest income shown in the income statement for the movement in the interest receivable balances (IR) shown in the balance sheet. A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method. Note that the additional information in this example stated figures related to cash receipts from customers and cash paid to suppliers and employees. You may need to determine these for yourself by using the figures in the financial statements and the additional information provided in the question. The changes in working capital (i.e. inventory, trade receivables and trade payables) do not impact on the profit but these changes will impact cash and so further adjustments are made.

The first is the direct method which shows the actual cash flows from operating activities – for example, the receipts from customers and the payments to suppliers and employees. The second is the indirect method which reconciles profit before tax to cash generated from operations. Under both of these methods the interest paid and taxation paid are then presented as cash outflows deducted from the cash generated from operations to give net cash from operating activities. The first is the direct method which shows the actual cash flows from operating activities – for example, the receipts from customers and the payments to suppliers and staff. The second is the indirect method which reconciles profit before tax to cash generated from operating profit.